Our focus is Asia Pacific region; our aim is to be the trusted strategic advisor to businesses, governments and institutions.

Globalization, a retracting European market and still abundant growth-opportunities in Asia, is transforming the world. Advanced technology is accelerating this change. Competition comes from unexpected angles disrupting once successful business models and growth strategies. At the same time rapidly changing social, technological and global market environments are threatening the viability of established businesses and the options they need to consider in order to survive and thrive.

To remain industry innovators and leaders, businesses need to prepare by developing growth strategies and transformation processes to stay ahead of the competition. This is nowhere more truly than in Asia. Asia's 4.2 billion population is only getting richer, their energy and infrastructure demands growing rapidly. The game is changing, with Asian governments increasingly relying on private sector participation. Needless to say the business opportunities are immense. However, Asia is a difficult market to enter and conquer. And this is where we come in.

Markland Infrastructure Asia is a Management Consultancy providing Clients with strategic and operational advice ranging from market entry strategies in Asian emerging markets, the implementation of green field projects, M&A, to the transformation and turnarounds of existing businesses.

Markland's management expertise and successful track-record includes over 20 years in Asia. This includes the development, acquisition and implementation of businesses throughout the Asia Pacific region. We have worked with both “start-ups” as well as developed and implemented restructuring and turnaround strategies taking growth companies to the “next level up”..

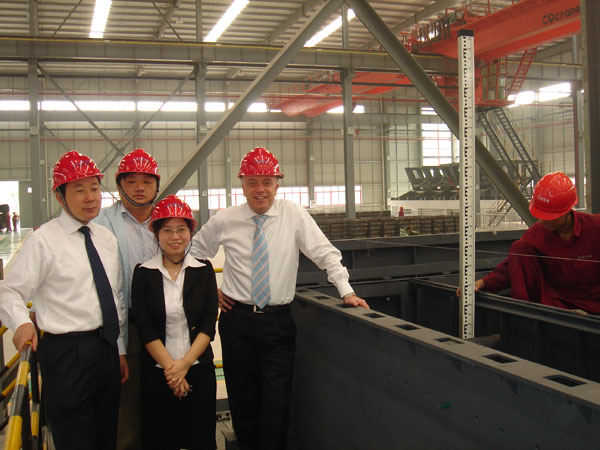

Chengdu

Markland Infrastructure Asia is a Management Consultancy providing Clients with strategic and operational advice ranging from market entry strategies in Asian emerging markets, the implementation of green field projects, M&A, to the transformation and turnarounds of existing businesses.

The management expertise and successful l track-record includes the development, acquisition and implementation of businesses throughout the Asia Pacific region over the last 20 years. This included both “start-ups” as well as developing and implementing growth strategies and managing companies to the “next level up” and the implementation of restructuring and turn-around of businesses.

With the Chief Minister of Delhi The Honorable Sheila Dikshit

We work with Clients in the following areas:

- Market entry strategies;

- Identifying of attractive projects and deal sourcing;

- Development of business cases;

- Implementation of green field projects;

- Identification and selection of partnership models;

- Identifying potential (JV) partners;

- Selection process and implementation of Joint Ventures;

- Identifying Mergers and Acquisition (M&A) targets;

- Strategic, Commercial and Technical due diligence;

- Risk identification and mitigation measures;

- Post M&A integration;

Signing Ceremony

And provide “Hands on Management Consultancy” in the areas of:

- Transformation, turnarounds and restructuring of existing businesses or assets;

- Strategy & Operations Management Consultancy including:

- Change management

- Faster execution

- Better alignment

- Senior team building

- Increased innovation effectiveness

- Right-sizing

Taixing, China

With Chief Minister of Gujarat, India, Mr Narendra Modi

Markland Infrastructure Asia brings a broad range of Management skills, in-depth knowledge and industry subject matter expertise to each unique Client situation.

We share and apply our knowledge and hands on Asian experience to the business issues faced by our clients. We tailor solutions to complex challenges that business leaders face when undertaking corporate decision making processes in Asia. We at Markland deliver objective expert advice throughout the project / business life cycle in the broadest sense and on the ground in Asia.

Markland works with Companies in the following areas:

- Market entry strategies

- Identifying attractive projects and deal sourcing

- Developing business cases

- Implementing green field projects

- Identifying and selecting partnership models

- Identifying potential (JV) partners

- Selection process and implementation of Joint Ventures

- Identifying Mergers and Acquisition (M&A) targets

- Strategic, Commercial and Technical due diligence

- Risk identification and mitigation measures

- Post M&A integration

We work with executive leadership in the following areas:

- Developing strategies for “start-ups”

- Developing and implementing growth strategies

- Providing management skills to take companies to the “next level up”

- Restructuring and ‘turn around’ of businesses

- Building eminence through thought leadership pieces

Markland works with companies in the following contractual formats and models:

- Public Private Partnerships (PPP);

- Build Operate Own and Transfer (BOOT);

- Design Build and Operate (DBO)

- Engineering, Procurement and Construction (EPC);

- Design, Built. Operate and Own;

- M&A

Further we provide “Hands on Management Consultancy” in the areas of:

- Transformation, turnarounds and restructuring of existing businesses or assets;

- Strategy & Operations Management Consultancy including:

- Change management

- Faster execution

- Better alignment

- Senior team building

- Increased innovation effectiveness

- Right-sizing

Finally, the sectors we, at Markland in Asia, cover are:

- Water-supply

- Wastewater treatment

- Municipal Solid Waste Management

- Waste to Energy

- Power generation

- Renewable Energy

- Power transmission and distribution

- Transport infrastructure

- Oil and Gas industry

Chongqing

Bejing, China

Asia Transformation and Turnaround

Effective Management Consulting

We at Markland believe that effective consulting requires strategy, design, and implementation. As we have been in executive strategic leadership positions with full P&L responsibility, we know that to design what a Client needs and make change happen, implementation requires:

- Expertise

- Methods

- Facilitation

Our expertise is our in-depth experience of management and organization best practices as well as knowledge of what is required to effect change in Asia. Change requires facilitation that can only come from outside the organization. Facilitation is having a trusted advisor provide guidance from a position of independence. We provide expertise and work with you in the analysis and design phase so you own the actions and implications for change and improvement. We strongly believe an organization is its people. Therefore we work alongside your people to effect the changes needed. In short while we provide expert guidance and are along your side every step of the way, you lead the change.

Change always requires more resources than steady-state operation. You will need additional "horsepower" and "bandwidth" to drive the change throughout your organization. We work alongside your people to effect the changes needed.

Change requires facilitation that can only come from outside the organization. Facilitation is having a trusted advisor provide guidance from a position of independence. We provide guidance and feedback while you lead the change.

Asia Transformation and Turnaround

"The Asia Transformation and Turnaround Association (ATTA) is a membership organisation of experienced international professionals providing business transformation and turnaround management services in Asia."

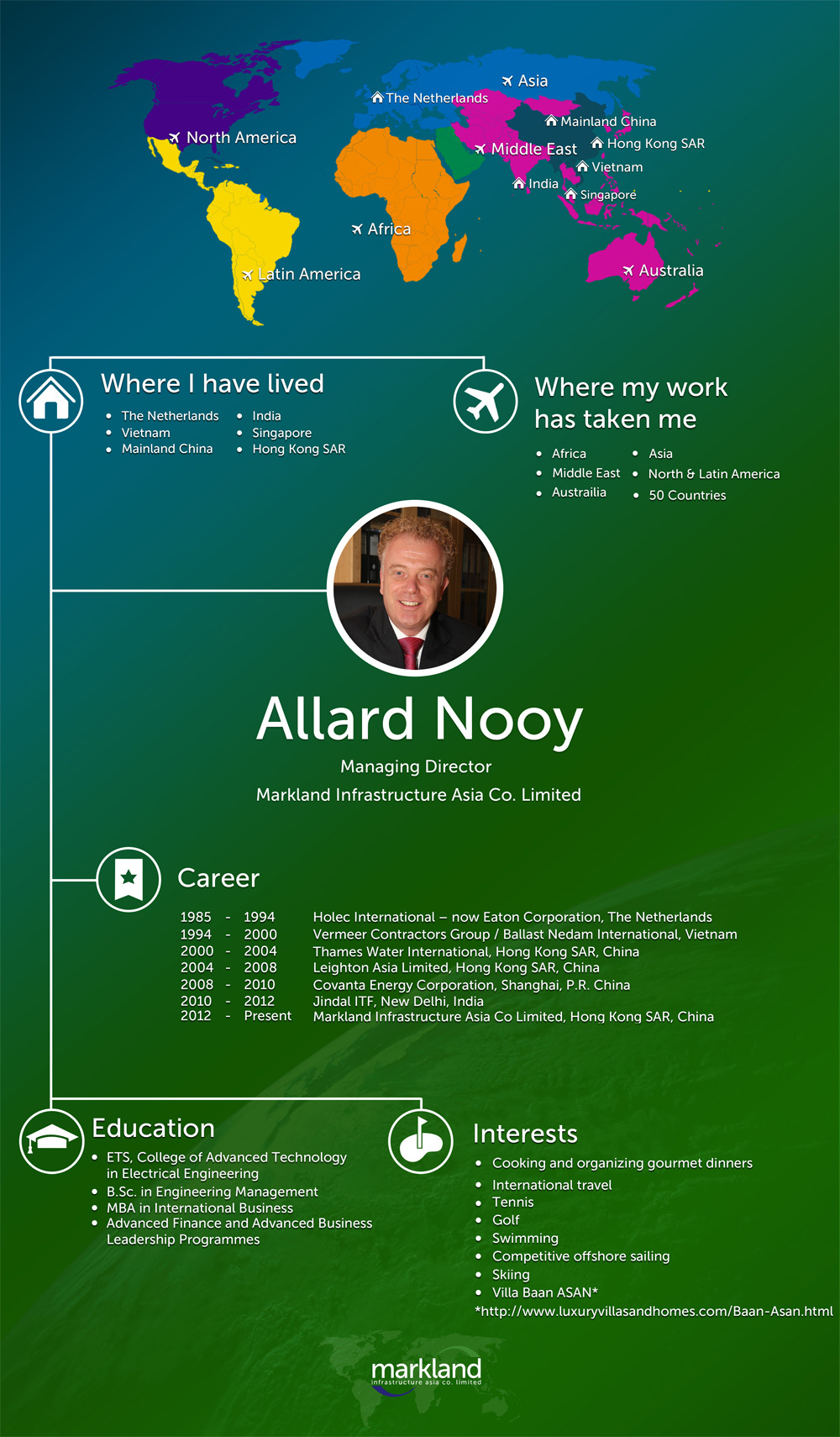

Allard Nooy has been qualified under the formal accreditation process by the Asia Transformation and Turnaround Association (ATTA). This is a membership organization of experienced international professionals providing business transformation and turnaround management services in Asia.

Asian companies are becoming global companies. In the process, they will run into unfamiliar challenges and need the advice of experienced transformation and turnaround professionals. One of the key roles of Markland is to support the evolution of Asian global business and share their experiences in global problem solving.

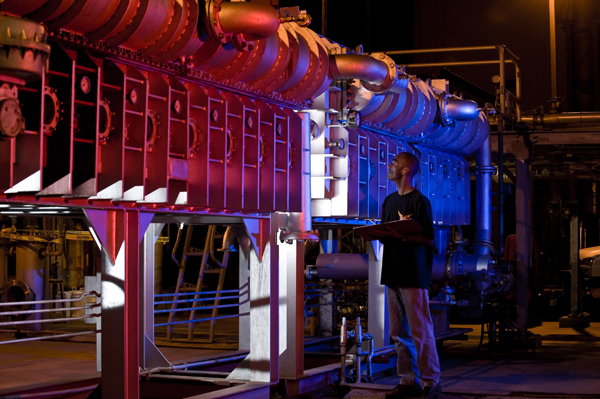

Power & Renewables

There is a need in the developing economies for generation from any and all sources, including both thermal and renewable technologies. In developed economies, companies are increasingly in search of knowledgeable equity capital to fund their continued growth or recapitalization of their balance sheets.

In Asia there are opportunities in thermal power generation (gas, coal or diesel-fueled) and renewable power (wind, solar, hydro, geothermal waste to energy and biomass).

At Markland we have Power and Renewables experience with extensive operational and investment experience spanning project life time cycles and company evolution stages throughout the regulated and deregulated international power sectors. We are able to originate and assess opportunities across the region and enable management teams to execute on targets.

Surging global demand for energy and resources promises growth for the power and renewables sector worldwide. Over the next two decades, it's estimated the global electricity sector will need more than $17 trillion of investments, with about half of this required for power generation. Approximately 80% of new generation capacity requirements will come from non-OECD countries (developing economies). While thermal generation sources will continue to play a significant role, due to the aim of overall carbon foot print reduction, renewable energy sources will gain in competitiveness and grow significantly as costs fall and efficiencies increase.

The on the ground Asian experience at Markland with both thermal power generation as well as renewables is extensive in particular from an owner / operator perspective.

Powering Ahead: 2010

This report provides an insight into the global M&A activity in renewable energy. The findings are based on a survey of over 250 senior executives active in the renewable energy industry worldwide. The survey and report were written in collaboration with VB/Research, a specialist renewable energy research and data provider. Transaction data and statistics included in the report have been extracted directly from VB/Research’s databases.The KPMG publication provides an insight into the global M&A activity in renewable energy. The findings are based on a survey of over 250 senior executives active in the renewable energy industry worldwide.

Allard Nooy said:

“The central Government in China has committed to significant renewable energy generation targets. By 2010, 10 percent of the total energy generation mix is expected to come from renewable energy sources”.

Read the full .pdf

Asia will need private sector assistance to develop its water, energy and waste infrastructure.

In the Asia-Pacific region private sector focus is shifting to more water, energy and waste treatment infrastructure, as in a rapidly growing market Asian governments struggle to shoulder the entire cost burden of development. Asian nations have spent trillions of dollars on transportation infrastructure in the hopes of boosting the region’s trade. Thus far infrastructure has been primarily paid for by governments.

However even with its high-speed rails and expansive highways, however, many of China’s cities still lack basic water and waste treatment systems. The country does not even have a unified electricity grid. Other Asian countries are in similar straits. India’s energy grid has been known to collapse for days at a time, and even developed nations like Japan and Australia face funding hurdles with government deficits and the sheer scale of infrastructure projects.

We at Markland can assist investors, owners / operators in infrastructure development to tap into these opportunities and to generate above average returns for shareholders.

Some nations have already started to turn to the private sector. Japan’s two Osaka airports, for example, are looking to raise as much as $15 billion from a private operator to run them for about 50 years. If this bid is successful, this predicts that Japan’s government deficits will encourage much more privatization.

India is also pushing through a $1 trillion, five-year infrastructure investment plan that relies primarily on the public-private partnership model. The Indian government is hoping the private sector will shoulder around 50 percent of the cost, with projects primarily focused on energy, water and transportation.

There is clearly an opportunity for the government and the private sector to come together in more innovative and effective ways to build, finance and improve existing infrastructure.

At Markland we have on the ground experience and deep knowledge of the development and implementation of Public Private Partnerships (PPP) and other contractual models including:

- Build Operate Own and Transfer (BOOT) projects

- Design Build and Operate (DBO) projects

- Engineering, Procurement and Construction (EPC) + Operation & Maintenance (O&M) projects

For Asian economies this critical if they are to meet their GDP growth and social equality targets, for the private sector it presents huge opportunity. This is where Markland comes in as we assist our Clients with a hands-on approach. Our 20 years+ on the ground experience in Asia has proven to be beneficial to those who are entering emerging markets and/or diversifying into new utility and infrastructure markets.

“Meeting global infrastructure demand comes with a huge price tag. The question remains who’s going to pay for it?”

The combination of governments’ need and investors warming up to the asset class spells opportunity for governments to tap into these nontraditional sources.

Some nations have already started. Japan’s two Osaka airports, for example, are looking to raise as much as $15 billion from a private operator to run them for about 50 years. If this bid is successful, this predicts that Japan’s government deficits will encourage much more privatisation.

India is also straining to push through a $1 trillion, five-year infrastructure investment plan that relies primarily on the public-private partnership model. The Indian government is hoping the private sector will shoulder around 50 percent of the cost, with projects primarily focused on energy, water and transportation.

There is clearly an opportunity for the government and the private sector to come together in more innovative and effective ways to build, finance and improve existing infrastructure.

We must find a way to make this work in Asia Pacific if our economies are to meet their GDP growth forecasts and social equality targets.

Water

The water industry in Asia is a growing market. The team at Markland Infrastructure Asia adds value to Clients given the experience from both ‘an owner and operator’ as well as an ‘Engineering Procurement and Construction Contractor’s point of view.In Asia, the experience has been gained from Senior Executive positions at Thames Water International, Jindal Water Infrastructure (JITF Aquasource) and Vermeer Ballast Nedam.

The experience and successful track record includes 20 years in Asia with both Public and Private sector Clients in the following areas:

- Municipal water treatment

- Municipal water transmission, supply and distribution

- Municipal waste water treatment

- Sewage sludge treatment facilities

- Industrial water treatment (Ultra Filtration and Reverse Osmoses)

- Industrial wastewater treatment

And in the following contractual formats and models:

- Public Private Partnerships (PPP)

- Build Operate Own and Transfer (BOOT)

- Design Build and Operate (DBO)

- Engineering, Procurement and Construction (EPC)

- Operation and Maintenance (O&M)

- Acquisitions

H.A.T.S. Hong Kong

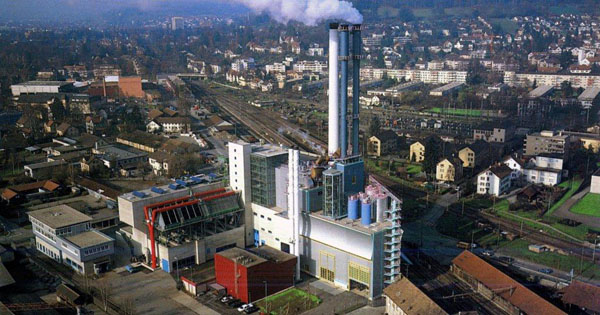

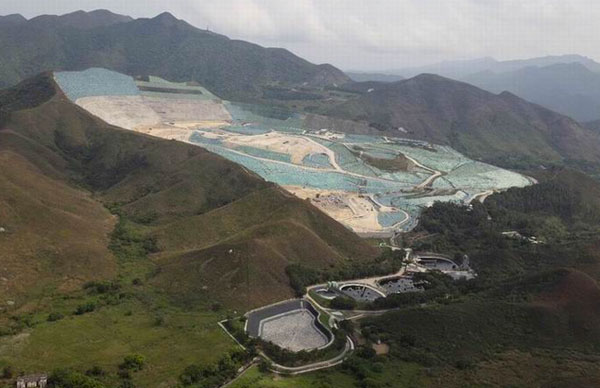

Waste Management

The waste management market and private sector participation in the industry in Asia is growing. The team at Markland Infrastructure Asia adds value to Clients given the experience from both ‘an owner and operator’ as well as an ‘Engineering Procurement and Construction Contractor’s point of view.

The on the ground experience in Asia has been gained from Senior Executive positions at Covanta Energy, Jindal Urban Infrastructure (JITF Ecopolis) and Vermeer Ballast Nedam.The track record includes 20 years in Asia in Municipal Solid Waste Management and disposal and in the following areas:

Our on the ground experience- Municipal Solid Waste Sanitary Landfills

- Sanitary landfill with biogas extraction and energy recovery systems

- Anaerobic digestion, bio-reactors, waste to biogas conversion

- Composting facilities

- Waste transfer stations

- Waste to Energy (WtE) or Energy from Waste (EfW) facilities

And in the following contractual formats and models:

- Public Private Partnerships (PPP)

- Build Operate Own and Transfer (BOOT)

- Design Build and Operate (DBO)

- Engineering, Procurement and Construction (EPC)

- Operation and Maintenance (O&M)

- Acquisitions

.jpg)

.jpg)